Introduction

Welcome back to Controversies. This week we move from lab failures to geopolitical fault lines: what happens when AI development itself becomes the organizing axis of great power competition. Building on the Wall Street Journal’s deep dive on the emerging AI Cold War between the United States and China, this briefing traces how model launches, chip bans, and national blueprints are hardening into a long-term struggle over computation, data, and influence.

In this briefing, we cover:

-

From Sputnik to DeepSeek – how one Chinese model crystallized Beijing’s ambitions, jolted Silicon Valley, and turned a tech gap into a full-spectrum mobilization.

-

Chips, swarms, and national clouds – why export controls, Huawei-style clusters, and “AI Plus” industrial policy are redefining where power in AI actually comes from.

-

Safety, standards, and everyone else – how an AI Cold War reshapes alignment incentives, fragments global norms, and forces smaller countries to choose between competing AI ecosystems.

Executive summary

The emerging AI rivalry between the United States and China looks less like a tech skirmish and more like a structural realignment of global power. America still holds a clear lead in frontier models, advanced chips, and private capital, yet Beijing has responded with a whole-of-nation mobilization: looser rules, subsidized compute, massive grid investments, and a swarm of domestic chip initiatives. China’s DeepSeek breakthrough has shown that the gap in model performance is narrow in some domains, even as U.S. export controls keep the cutting edge of hardware out of Chinese hands. The result is an AI Cold War in which both sides race to deploy systems that will transform their economies, militaries, and information ecosystems, while simultaneously eroding incentives to cooperate on safety, cybersecurity, and global standards. The outcome will not be determined only by who spends more or who has the most powerful single model, but by who can turn AI into durable advantages in chips, energy, data, talent, and governance without triggering the kind of instability that undermines their own power.

1. From generative shock to an AI Cold War

The release of ChatGPT in late 2022 was often described as a Sputnik moment for China. Initially, American companies such as OpenAI and Google dominated the generative AI frontier, while many Chinese firms leaned on open-source models like Llama and struggled with U.S. controls on high-end chips.

Beijing’s response transformed that technological shock into a strategic contest:

-

AI is now framed as a foundational capability, akin to nuclear weapons or digital computing during the original Cold War.

-

Both capitals see AI dominance as essential for future economic growth, military capability, and ideological influence.

-

Concerns about disinformation, bioweapons design, and loss of control over advanced models have not slowed deployment as much as many safety researchers had hoped.

The result is a self-reinforcing dynamic: each side points to the other’s progress to justify fewer constraints at home, turning AI into a classic security dilemma rather than a purely commercial race.

2. China’s AI pivot: from dependency to DeepSeek

For much of 2023, Chinese firms were lagging in generative AI:

-

Heavy reliance on foreign architectures and open-source models.

-

Severe constraints on access to top-end GPUs due to U.S. export controls.

-

An initial regulatory approach that prioritized content control over raw experimentation.

That shifted in 2024-2025 as Beijing reorganized its strategy.

Regulatory loosening and state support

Chinese regulators:

-

Simplified approval procedures for generative AI services.

-

Relaxed some requirements on training-data disclosure for firms with good compliance records.

-

Allowed more flexible use of overseas compute for training, despite formal chip restrictions.

At the same time, local governments offered subsidized access to compute, built public datasets, and organized roadshows to match startups with investors.

The DeepSeek effect

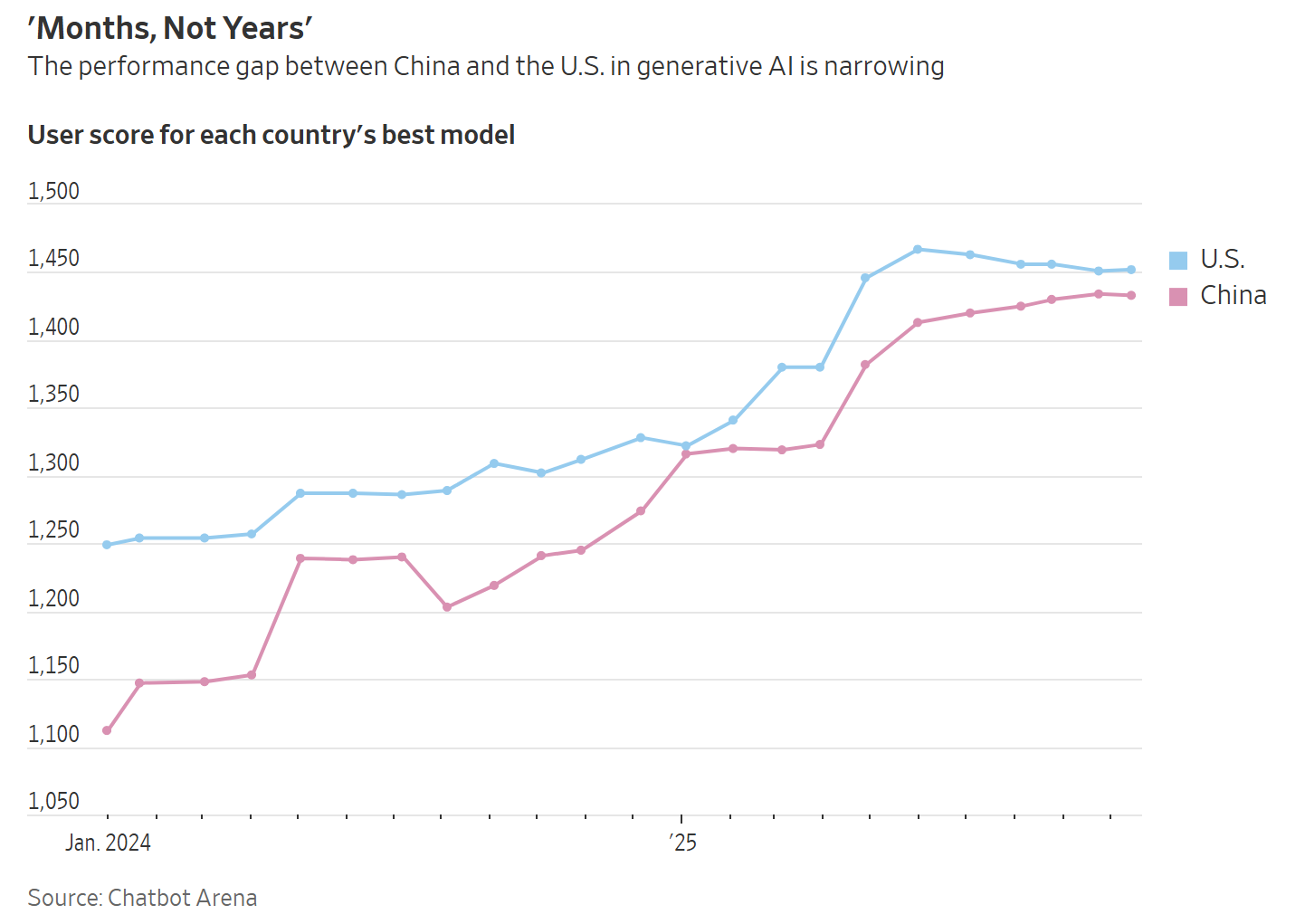

The major psychological and strategic inflection came with DeepSeek’s R1 model, which reached performance in some benchmarks comparable to leading Western systems at far lower training cost.

DeepSeek changed the narrative in three ways:

-

It showed that Chinese research talent could compete at the frontier even without perfect access to Nvidia’s best chips.

-

It provided Beijing with a domestic success story to rally around.

-

It spurred incumbents such as Alibaba to commit tens of billions of dollars toward artificial general intelligence over the next few years.

In response, Xi Jinping convened top tech leaders and signaled that AI was now central to China’s national rejuvenation project, not a side experiment.

3. America’s edge: models, money, and Moore’s law

Despite China’s acceleration, the United States still holds a significant lead on several critical dimensions.

Frontier models and research ecosystems

-

The most powerful closure-weighted models, including GPT-class and Gemini-class systems, are still developed by U.S. or U.S.-aligned firms.

-

Silicon Valley and allied hubs maintain an advantage in research culture, tooling, and open scientific exchange, even as large parts of the stack are proprietary.

Private capital and startup dynamism

-

U.S. investors poured roughly $100+ billion into AI startups in early 2025, an amount China cannot easily match through state programs alone.

-

This capital is not just larger in volume, it is also more risk-tolerant, enabling aggressive bets on foundation models, robotics platforms, and specialized chips.

Chips and manufacturing depth

-

U.S. policy has entrenched an advantage in advanced semiconductor manufacturing, both through export controls and domestic industrial policy.

-

Firms like Nvidia continue to push the frontier with accelerator platforms that set the de facto standard for AI training and inference.

Several U.S. analysts estimate that Washington’s effective lead on cutting-edge chips is measured not in months but in many years, especially once fabrication capacity and supply chains are considered.

4. China’s counterplay: swarms, national clouds, and AI Plus

Beijing’s answer is not to replicate the U.S. one-to-one, but to change the game board.

4.1 Swarms beat the titan

Because China cannot easily import the latest Nvidia parts, it is pursuing a strategy some insiders summarize as “swarms beat the titan”:

-

Domestic firms such as Huawei are bundling very large numbers of local chips into massive clusters, sometimes reportedly up to a million units.

-

These clusters use more power and are less efficient per chip, but aim to match aggregate compute at lower cost or with fewer regulatory constraints.

-

Local governments subsidize electricity for data centers that prioritize domestic hardware, effectively socializing the inefficiency of the swarm strategy.

This is a classic Chinese industrial-policy move: accept hardware disadvantages, then compensate with scale, coordination, and subsidies.

4.2 A national cloud and AI Plus

China is also constructing a shared national compute fabric:

-

Clusters in regions like Inner Mongolia harness cheap solar and wind power and are linked into a national cloud that multiple actors can tap.

-

Xi’s “AI Plus” blueprint targets AI usage across 70 percent of the economy by 2027 and 90 percent by 2030, embedding AI deeply into manufacturing, logistics, and public administration.

Rather than focusing only on headline models, Beijing is pushing for system-wide permeation of AI into:

-

Heavy industry and smart factories.

-

Agriculture and logistics.

-

Surveillance, public services, and propaganda operations.

In effect, China is turning AI into a general-purpose infrastructure, not just a consumer internet layer.

5. Safety versus speed: when fear overrides caution

A defining feature of this AI Cold War is the way fear of falling behind undermines safety governance in both countries.

The U.S. dynamic

-

Policy documents in Washington now explicitly link AI safety regulation to concerns about Chinese competition.

-

Reports such as the hypothetical “AI 2027” scenario have popularized the idea that slowing down too much could hand the initiative to Beijing, even if systems are showing dangerous emergent behavior.

The political risk is that short term strategic fear blunts the appetite for meaningful constraints on frontier models, especially in defense and intelligence applications.

The Chinese dynamic

-

Beijing’s early focus on content censorship and algorithm transparency has given way to a more permissive regime for firms that align with state priorities.

-

There is strong incentive to deploy AI tools that strengthen social control, information shaping, and surveillance, often at the expense of privacy or civil liberties.

The shared outcome is grim:

-

Less room for international coordination on misuse risks such as biodesign, cyber offense, or fully autonomous weapons.

-

Greater investment in offensive cyber capabilities, as AI makes hacking more scalable and automated.

-

A rising probability that catastrophic incidents will occur long before global institutions adapt.

6. Will scaling decide the winner, or will scaling plateau?

A central technical uncertainty cuts across this geopolitical rivalry: how far can scaling laws take us.

Experts like Helen Toner have emphasized that the race might hinge on whether simply increasing compute, data, and model size continues to deliver significant gains.

Two broad scenarios emerge:

-

Scaling continues to deliver large returns

-

U.S. chip leadership and private capital remain decisive.

-

Export controls that limit China’s access to the latest accelerators translate into a persistent performance gap.

-

China’s swarms strategy narrows but does not close the distance, especially if energy infrastructure becomes a bottleneck.

-

-

Scaling plateaus and new paradigms dominate

-

Breakthroughs in algorithms, architectures, or hybrid reasoning systems matter more than raw FLOPs.

-

China’s focus on pervasive deployment and large domestic user bases could generate rich experiential data that favors them.

-

Open-source and distributed research ecosystems could erode the value of any single country’s proprietary lead.

-

The uncomfortable truth for both capitals is that nobody knows which path reality will follow. Betting everything on one set of assumptions could prove strategically catastrophic.

7. Global implications: beyond Washington and Beijing

For the rest of the world, the AI Cold War is not a spectator sport. It comes with a series of second-order effects that will reshape global politics and economics.

1. Standards and alignment blocs

-

Competing visions of AI governance will be embedded into international standards bodies.

-

Countries may be pressured to align with either “democratic AI” ecosystems or “authoritarian AI” standards that emphasize control and data access over individual rights.

2. Infrastructure and energy geography

-

Large AI clusters require massive amounts of power and water, which will reconfigure global energy investment and grid planning.

-

Nations that can offer cheap, stable, low-carbon power plus legal certainty may attract data centers and research labs, becoming AI infrastructure hubs.

3. Cybersecurity and espionage

-

AI-augmented hacking will increase the frequency and sophistication of cyber operations aimed at stealing weights, training data, and chip designs.

-

Domestic resilience, from hospitals to power grids, will increasingly depend on AI-native cyber defense.

4. Inequality of capabilities

-

Nations that lack access to frontier models or advanced chips risk becoming permanent digital clients, dependent on one bloc’s platforms.

-

This may deepen existing development gaps, as access to AI-enhanced education, healthcare, and productivity tools diverges.

8. How this AI Cold War really gets decided

The narrative of a simple U.S. versus China race over who builds the biggest model obscures the real strategic variables.

The contest will likely be decided by the interaction of:

-

Hardware ecosystems: Who controls the most reliable and advanced supply chains for chips, equipment, and power.

-

Software and research cultures: How open research, talent flows, and firm-level experimentation feed into model quality and reliability.

-

Deployment depth: Which side integrates AI most deeply into logistics, manufacturing, finance, and defense, not just consumer apps.

-

Governance quality: Who manages to reap transformative benefits without triggering systemic crises, from rogue models to destabilizing cyber operations.

-

Alliance networks: Which ecosystem can offer compelling economic and security packages to third countries, turning them into long term partners rather than reluctant clients.

In that sense, the AI Cold War is not simply about who gets to AGI first, or who trains the largest model. It is about who can build a coherent socio-technical system around AI that is powerful, resilient, and legitimately attractive to others.

If there is one lesson from the computing race of the original Cold War, it is this: technological victories that are not coupled to broad-based prosperity, stable institutions, and trusted alliances have a way of turning into Pyrrhic wins. The current AI competition will be no exception.

For the full details: The AI Cold War